The 3 Ways L&D Will Bungle the SEC Opportunity

This past August the SEC passed new regulations requiring reporting on Human Capital as part of a public companies standard reporting process. Since that time there has been much talk about what this means for L&D. Some have begun to suggest ways to use this new regulation as an opportunity to reshape L&D’s position in a company. Some have even said that this is a chance to finally get that coveted “seat at the table.” I may even be included in the group of “some” people. However, if I look at it honestly. If I look at an industry that has continued to fight the same battles for relevance and stature across the two decades I have been part of it. If I do those things I have to admit that it is likely that L&D bungles this chance.

Remember I am one of Learning’s biggest fans. I have repeatedly written love letters to the power of learning and lamented the lack of widespread executive support. And bungle isn’t a complete miss. Bungle is simply an awkward failure to capture the full opportunity. Like the quarterback who trips on the turf as he runs without a defender in sight. Apologies for the sports analogy but the Eagles are on in the background as I write this.

The good news is that L&D won’t be in the spotlight when it trips. This regulation comes at a time when all eyes are on Diversity & Inclusion and the environment. So unless L&D starts measuring a meaningful reduction in carbon footprint due to online learning (not a bad idea) it will not be in the spotlight for a bit. Unless we put ourselves there. We all should. Most won’t.

Bungle No.1: Misread the Moment

Human capital is a material resource for many companies and often is a focus of management, in varying ways, and an important driver of performance. – SEC regulation

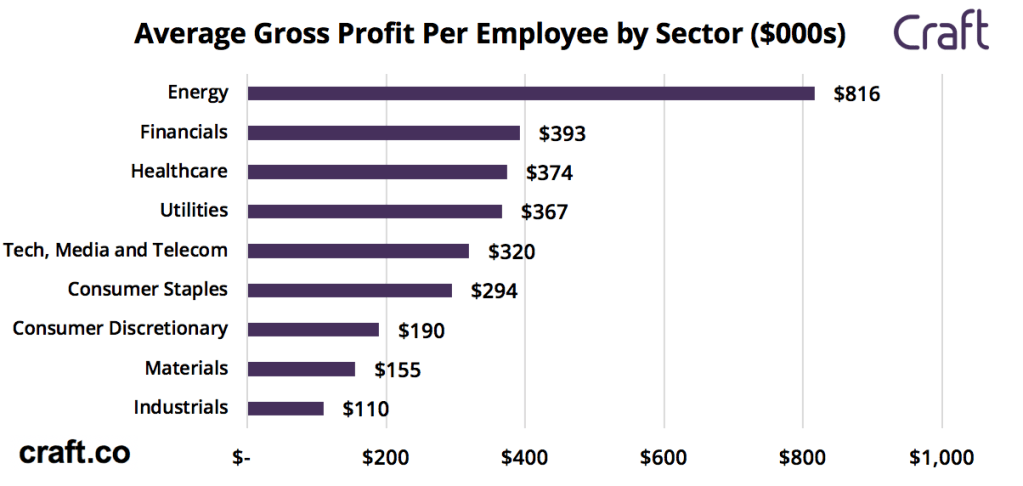

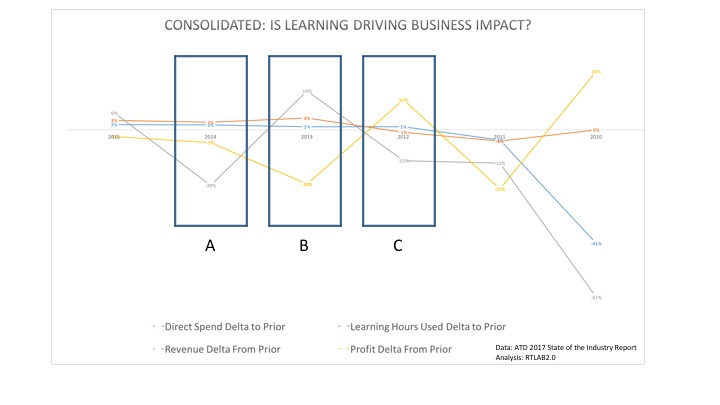

You hear government regulation and what is the first thing that comes to mind? Compliance? This could easily be read as a compliance initiative. It is and it isn’t. By treating this as a tick the box exercise L&D misses the point. This is a coming-out party. This is L&D being introduced to the world as the new battleground on which companies will compete. It is an endorsement of the importance and power of Human Capital strategy. And we are not talking about foosball tables and executive chefs serving free lunches. L&D is on the front lines and as such can now get the resources, attention, and investment it has longed craved. But before the supply lines start to flow, L&D has to show its value to the markets; financial and employment. For a function that has struggled to show its value to business leaders, this is going to be a heavy lift.

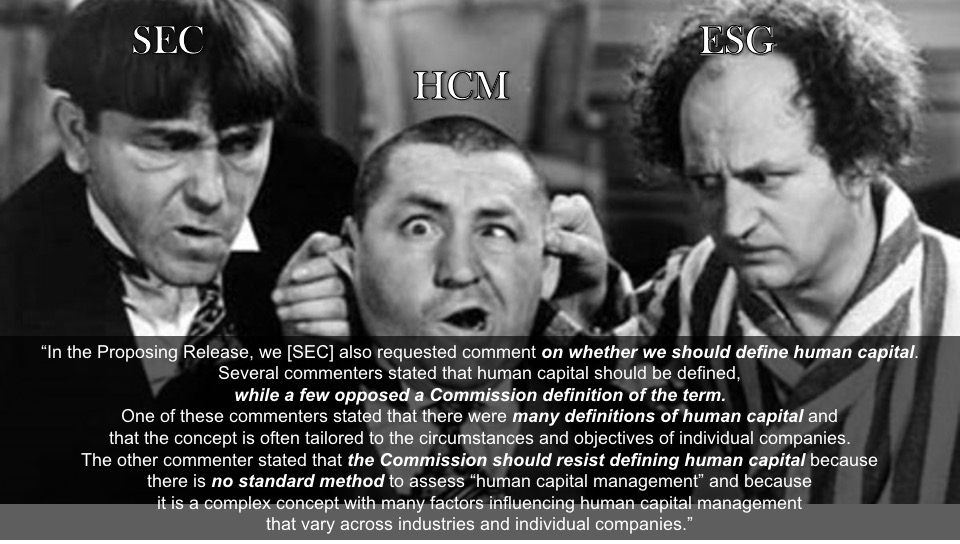

Bungle No.2: Look for the “Right” Answer

“…to the extent such disclosure is material to an understanding of the registrant’s business taken as a whole…” – SEC regulation

Have you ever told a bartender to “just make me something you think I will like”? Order takers like clarity. Tell me what you want and I will deliver it. In the case of L&D, we have struggled long and hard to produce an impact with our solution despite what our customers ordered. But we like taking orders. It is safe. You asked for it. We delivered it. Job well done. Now I know that lots of you are mad at me right now. “We have business partners’” you will scream. “We measure level four impact on all our programs, “ you will wail. Ok fine.

Now, how about this. The SEC regulation is not “prescriptive.” The SEC provides only examples (total invested, hours per employee) not fill in the blank questions. The regulation is principle-based. This means it is up to the company (the L&D organization) as to what data they provide. So will your L&D organization accept the order, reporting sample metrics only because we know they are right since they were provided. Or will your organization go to battle armed with the superpower our industry has longed for, materiality? The Supreme Court has defined materiality but now the task is on us to define it for our organization.

– Is that new Management training program material to our overseas expansion plans?

– Is the Onboarding redesign material to achieving our growth targets.

– Is our upskilling initiative material to minimizing our labor costs?

– Is our new product curriculum material do the upcoming roll-outs?

– Is our OSHA training digitization material to our reportable and claims costs?

We know the answer is yes to all. The question is are we going to self-inflict ourselves with a higher reporting burden. Even if that burden comes with a new view of the role, power, and import of learning. Or will we wait until it gets ordered up? Which it will. You could argue that everything related to employee learning is material to understanding the businesses we serve. But this probably overstates the business value of some provided learning. What if you lose that argument? And what if it’s your course that is deemed immaterial? What does that say about that course? Scared yet?

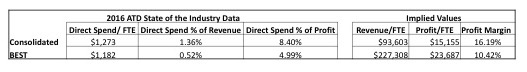

Bonus Bungle: Data Arrogance

Another bungle looming for L&D is overconfidence in their data ecosystem. I almost left this one off entirely because honestly, I am tired of holding a mirror up to L&D’s data maturity. SEC reporting is not for the faint of heart. These numbers don’t come with a bunch of excuses. Do you get a long litany of caveats and qualifiers every time there is a data readout? Bad data, crazy outliers, incomplete fields. That will not do. And it’s not just the data but also the control systems and processes that surround them.

Had a data audit recently? Not by an L&D service provider selling you the latest platform or reporting service but by an accounting firm. Are you familiar with COSO Internal Control-Integrated Framework? You better get familiar. This is the standard used by many auditors.

Principles-based reporting means the norms will be set based on demands from ESG certifiers (they will push for some standard items they can compare across companies), candidates (who will vote with their job applications), and investors who will reward companies that do this well and sue those that don’t. Yes, I said “sue.” If the report did not include something material, the number was misleading, or the number was wrong, then into court you go. As Peggy Parskey, a keen observer of this space, commented in a recent conversation, “Is L&D ready to testify?”

Bungle No.3: Fear

OK, I am just going to say it. This is scary, The door is open. Right through there. Just step into the limelight. This isn’t filling out the self-reported data for ATD. This isn’t a quick 4 slide report for some executive presentation. This could be it. The real deal. Finally. A core part of the business. A seat at the adults’ table. This is not a Zoom meeting to hundreds, It is an interview on CNBC. It is right there. If you reach your hand out you can touch it. Some of your peers in Europe have it. Don’t you want it? It is going to be a lot of work. You could just wait and see what they want. But the door is right there.

The Unbungling

The new reporting requirements offer L&D lots of opportunities. It is up to L&D to capture them. This is more than possible, this is in our wheelhouse. This is what we do. We enable change. We should be leading HR during this critical window. We should be facilitating discussions around what is “material”, we should be enabling process skills related to controls, we should be doubling down on data fluency, we need to frame our contribution in the most valuable light for our enhanced stakeholder audience. If we sit back and wait for the order the perception of L&D will not change in a meaningful way and this window will close. Will it be the end of the world? No. Will we wish we had done more? Probably.